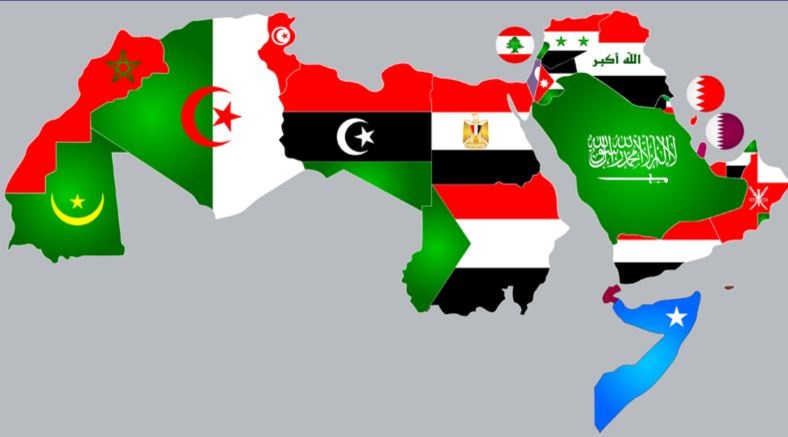

INTRA-ARAB TRADE HURDLES AND SOLUTIONS

ARAB INTRA-TRADE

On

contemplating the reality of the Arab intra-trade, it is revealed thatit does

not go beyond 10% ofthe total Arab foreign trade. This would raise a logical

question about the reasons forweakness of Arab intra-trade, despite the fact

that our great Arab countries enjoy natural resources, financial and huge human

resources. Not to mention, the geographical unity and the strategic location

that links East and West.

All

these elements can make the Arab world a great economic power that plays an

important role in the global economy.

To answer the question of why Arab trade is weak?

We will brieflydiscuss some of the obstacles and problems that stand in the way

of the growth of intra-Arab trade. Let’s start

OBSTACLES & ISSUES HOLDING BACK

ARAB INTRA-TRADE

First: Non-Tariff Restrictions: These restrictions represent a real obstacle outdoing other constraints.

Following are among these constraints:

·

Administrative

restrictions:

Administrative

Restrictions refer to those restrictionsrelated to the re-evaluation of customs

and the number of unnecessary documents required with the goods. Elimination of

such restrictions requires adopting the value of the invoice in the valuation process.

Such can be done through the application of the rules contained in the WTO in

this regard. Administrative restrictions also include transit time.

·

Technical

limitations:

Technical limitationsrefer to those constraints related to the specifications wherein

multiplicity of specifications among countries for a single productvary.

Moreover, inconsistencies in application and sometimes the length of time

required to issue and ratify the certificate are also considered an example of

these technical constraints. Not to mention, some Arab countries also change

the specifications without prior notice.

It is worth mentioning too that the agreement concerned withfacilitation

and development of Arab Trade among Arab countries and its Executive Program

called for immediate elimination of all non-tariff restrictions since these

restrictions have a direct impact on obstructing inter-Arab trade.

Second: Duties

& Fees with similar effect of the Customs tariffs:

Imposition

of duties and taxes with similar effect of the customs tariff on Arab goods imported

from the Arab countries will lead to disruption of the effect of the customs

reduction. Moreover, additional taxes and fees are considered among the main

impediments that hold back the optimal implementation of the Grand Arab Free

Trade Area, such as customs duties, fees for document attestation, charges of

statistics and customs services, in addition to the charges and fees of public

interest such as veterinary fees and road traffic charges.All such charge and

feeshave adverse effect on the value of the goods.

Third: Regulations

of Origin / Detailed Regulations of Origin:

The

detailed rules of origin of Arab products are considered one of the main

pillars of the Grand Arab Free Trade Area.Through adopting such agreement, it

is possible to prevent infiltration of foreign products into Arab countries

benefiting from the advantages offered by the region to Arab products.Furthermore,it

is the means by which productive integration can be achieved among Arab

countries – taking benefit from theregulations of Cumulative origin.

It is worth mentioning that the Arab General Regulations of Origin, which are

concerned with the purposes of implementing the agreement on facilitating and

Developing Trade between Arab Countries has set 40%as an added-value for Arab

produced goods.

Slowdown and lack of agreement on the regulations of origin will have negative

repercussions. The agreement on the detailed regulations of origin is considered

trade policies practiced by states in the context of encouraging

inter-investments and employing them in the service of the required economic

integration.

Fourth: Land

Transportation:

Land

Transportation is one of the most important obstacles standing against

achievement of intra-Arab trade, since we do not yet have roads or land

transport networks linking the countries of Morroco, Tunisia and Algeria with

the Eastern and GCC countries. In short, absenceof regular transport between

Morocco and the Levant at competitive prices makes trade between the two wings

of the Arab region is so meagre.In addition, there are complications on the

borders between Arab countries and the length of time.Therefore, land transportation

is viewed as one of the most obstacles that hold back liberalization of

intra-Arab trade. Accordingly, we must reformulate the Land Transport Agreement

(Transit) between Arab countries or work to develop such agreement in a manner

that would serve the public interest.

Fifth: Lack of

Information Required for Inter-Arab Trade

The

private sector suffers from lack of official information pertinent to

commercial facilities, mainly customs services, transport, transit, banking,

insurance and consulting services. There is also lack of information regarding

Arab markets, commodities, patterns of consumption, specifications, standards,

and quality.

Sixth:

Difficulties of Mobility of Indivduals& Capital among Arab Countries

Finally, the real solution of all such impediments that hold back inter-Arab trade begins in the first place with a genuine political will towards achieving Arab economic integration and denouncing all differences between Arab countries. Hence,we could seriously search for the real return of Arab capital migrating out of our Arab region, where investment is the true link to the economic integration cycles and simplification of trade movement from production areas to the consumer areas, development of infrastructure, and full coordination of all new investments up to the stage of integration rather than competitiveness. Standardization of specifications and working hard to achieve customs cooperation is the main link in implementation and fulfillment of economic integration requirements.

Taha

Mohammed Qulaisi

Vice Chairman,AUCE